Calculate sell price from cost and margin

The firm incurs Direct Labor expense of 40 per pairs. Calculate Gross Profit Margin on Services.

Etsy Pricing Calculator Find Out Your Etsy Fees Recommended Pricing And Potential Profit Margins Pricing Calculator Etsy Business Craft Business

The average inventory is the item price minus discounts plus freight and taxes.

. Here are the steps to calculating gross margin. Profit Percentage Markup Net Profit SP CPCost Price CP X 100 Profit Percentage Margin Net Profit SP CPSelling Price SP X 100 Lets understand the application of these formulae with the following simple example. The price of the product is the price set by the firm to sell at wholesale price or cost of manufacturing the product plus mark up.

With a markup percentage of 50 you should sell your socks at a 250 markup or a total price of 725. This includes the cost of materials labor overhead administrative expenses shipping and any other cost you incurred. To calculate your break-even units to sell before net profit.

Profit revenue - costs so an alternative margin formula is. Gross Profit Margin Revenue Cost of Goods Sold COGS Revenue. The profit equation is.

Lets deal with Price variance first. Gross Profit Margin Net Sales Cost of Goods Sold COGS Net Sales. Any change in price directly impacts Profit margin.

Break-Even Price Formula Example 3. Wholesale margin is calculated by taking the difference between the manufacturers price and the wholesalers price to the retailer and dividing it by the wholesalers price. For example a company buys pairs of shoes for 60 and sells each pair for 100.

Selling price - cost of goods selling price gross profit. The firms GMROI then is 25 for the boots divided by the median value of 20 which equals 125 GMROI is 2520 125. Then divide this figure by net sales to calculate the gross profit margin in a percentage.

For example 001 equals 1 01 equals 10 percent and 10 equals 100 percent. Calculate the cost of goods sold. You find this figure by multiplying the total quantity of goods sold by the price it sold for.

An ice cream shop sells vanilla cones that originally cost 400 but the price went up. You probably already know how to calculate a profit margin. That is the minimum limit for determining the selling price.

If you divide that by roughly 30 days in a month youll need to sell 20 cups of coffee per day in order to break-even. Youll need to sell 600 cups of coffee every month if you want your business to be profitable. They offer a 2 discount if the customer pays with cash.

You can find out how to calculate the gross profit margin for your business using the method below. Assume that market prices fall to a level below the firms unit cost. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made.

Cost x 50 Margin Cost Selling Price Result. Say the company has a high-cost structure. Subtract the 100 cost of a can of soda from the 200 selling price.

If your business sells products you need to know how to calculate the cost of goods sold. So how many cups will you need to sell per month to be profitable. Break-even units overhead expenses unit selling price unit cost to produce Example.

Cost Per Unit can be defined as the amount of money spent by the company during a period for producing a single unit of the particular product or the services of the company which considers two factors for its calculation ie variable cost and the fixed cost and this number helps in determining the selling price of the product or services of the company. Lets plug it into the formula. GMROI is calculated by dividing the gross margin by the inventory cost.

So if a wholesaler buys an item from the manufacturer at 5 and sells the item for 10 their wholesale margin is 50. Wed sell it for 23333. If you know the units sale price and cost price and the business operating expenses you can calculate the number of units you need to sell before you start making a profit.

How to Increase the Gross Margin Ratio. To calculate manually subtract the cost of goods sold COGS from the net sales gross revenues minus returns allowances and discounts. True food cost gross profit margin.

Combine the variables to determine the gross margin. Here are two easy ways to calculate a profitable selling price. Shopifys free profit margin calculator does it for you but you can also use the following formula.

Subtract the cost of the voucher from the price received from its sale. The difference is gross profit. Our gross profit is 23333 140.

Calculate the cost of goods sold. To calculate the Gross Profit Margin percentage divide the price received for the sale by the gross profit and convert the decimals into a percentage. The ratio measures how profitably a company can sell its inventory.

Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. The formula for gross margin percentage is as follows. Margin 100 revenue - costs revenue.

5 x 50 250 5 725 New Selling Price. Suppose we sell a pen for 10 in the market and the variable cost is 6. This means that for every dollar generated 03826 would go into the cost of goods sold while the remaining 06174 could be used to pay back expenses taxes etc.

Calculate the contribution margin of the pen. Now that you know how to calculate profit margin heres the formula for revenue. If the company sells two pairs of shoes to a customer who.

Keep in mind that gross margin is the net sale of goods minus. That means you will earn a profit of 250 on every pair of socks sold. This calculation includes all the costs involved in selling products.

Gross profit margin shows how efficiently a company is running. A business ideally wants to sell a good that isnt too elastic because it gives them more control in the market but it isnt really up to them. Calculating the cost of goods sold COGS for products you manufacture or sell can be complicated depending on the number of products and the complexity of the manufacturing process.

We can calculate the contribution margin of the pen by using the formula given below. Since gross profit margin is most often depicted as a percentage you would need to convert the result of the above formula to a percentage by multiplying it by 100. Let us take the example of a manufacturing business that manufactures shoes.

Average cost of goods manufactured profit margin wholesale price The average cost of manufacturing or procurement includes every single cost involved in making the products available 4. 100 is your gross profit. Margin and Markup move in tandem.

To calculate the profit percentage you will need the below-mentioned formula. Revenue 100 profit margin. A higher ratio is more favorable.

For example a 40 markup always equals a 286 profit margin 50 markup always equals a 33 margin. If youre curious about how to calculate a goods price elasticity of demand follow these steps. So for example for Apples the selling price for 2018 is 11 660 Sales 60 units sold.

Cost Per Unit Definition. If it adopts cost-plus pricing the company cannot reduce the price below the cost per unit. An item that sells for 10 and that costs 3 would generate gross profits of 7 selling price - cost of goods and a gross profit margin of 70 7 10.

Start by calculating total revenue for the desired period. Therefore the business has to sell at the break-even price of at and above 205 to sustain the costs of producing 2000 new chairs. And at that level cost per unit the company doesnt make a profit.

From the data available you can easily calculate the selling price per unit of each fruit Amount of Sales for each fruit sold divided by the number of units sold. Margin also called Gross Profit Selling price Cost of goods sold. The break-Even price for the business 205.

Gross_margin 100 profit revenue when expressed as a percentage.

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

How To Calculate Your Profit Margin Profitable Business Financial Tips Business Finance

How To Calculate Gross Profit Margin Profit Profitable Business Cost Of Goods Sold

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

Use The Online Margin Calculator To Find Out The Sale Price The Cost Or The Margin Percentage Itself In 2022 How To Find Out Calculator Percentage

Retail Markup Calculator Markup Pricing Formula Excel Margin Etsy Pricing Calculator Pricing Formula Stock Market

6 Ways To Increase Profit Margin For Ecommerce Businesses Customer Loyalty Program Loyalty Program Customer Loyalty

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

Distribution Channel Margin Calculator For A Startup Plan Projections Start Up Channel Business Planning

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Markup Calculator Math Calculator Calculator Way To Make Money

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Pricing Strategy Template Selling Price Margin Calculator Pricing Calculator Handmade Business Business Planner

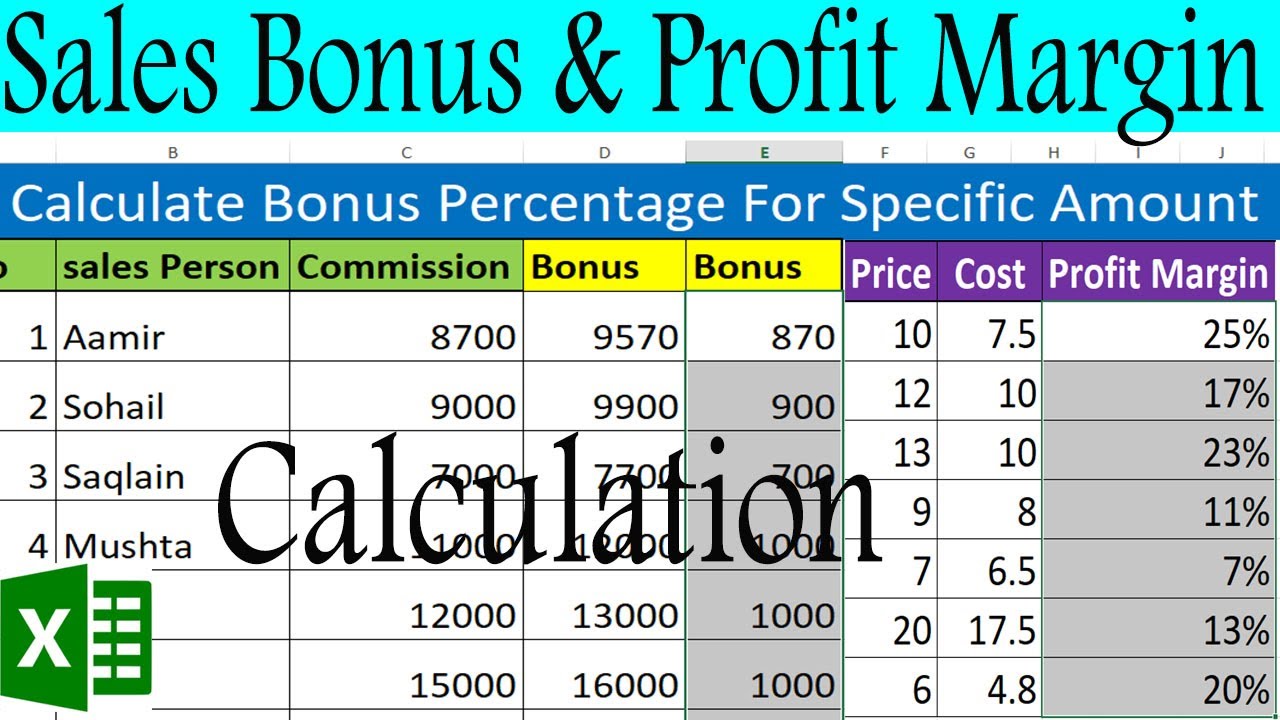

Excel Sales Bonus And Profit Margin Calculation By Learning Center Learning Centers Learning Free Learning

Estimated Profit Margin And Roi Profit Cost Of Goods Sold Estimate